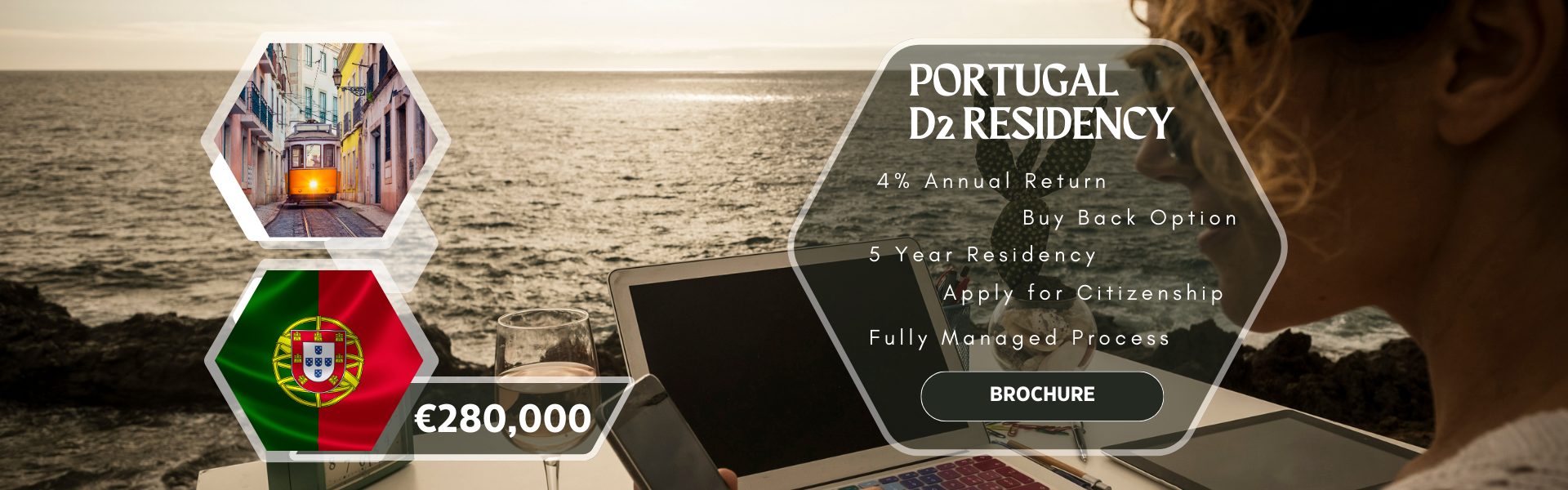

Featured Properties

Handpicked Investment Properties Tailored for You.

BondTilli takes pride in offering a curated selection of premium properties that not only serve as a sound Golden Visa investment but also cater to your lifestyle aspirations. From beachfront villas to city apartments discover properties that resonate with your vision.