Portugal Golden Visa Investment Funds: A Comprehensive Guide

Investors seeking residency in Portugal have a golden opportunity with the Portugal Golden Visa investment Fund. Among its various investment options, the Portugal Golden Visa Fund is an attractive pathway for those seeking residency through strategic investments.

In this comprehensive guide, we will explore what the Portuguese Investment Fund entails, who can benefit from it, its advantages and disadvantages, associated fees, required documents, investment timeline, and more. By the end of this article, you will clearly understand whether the Portugal Investment Fund Golden Visa is the right choice for you.

Overview of the Portugal Golden Visa Program

The Portugal Golden Visa Program was created in 2012 to encourage non-EU/EEA citizens to invest in the country and boost its economy. This program offers residency to investors who make qualifying investments, making Portugal an attractive choice for those seeking European residency.

The initiative has attracted significant foreign direct investment, with over €6 billion invested by 2022. Non-EU-EEA or Swiss citizens with a clean criminal record can obtain a Golden Visa, a residency permit acquired through eligible investments.

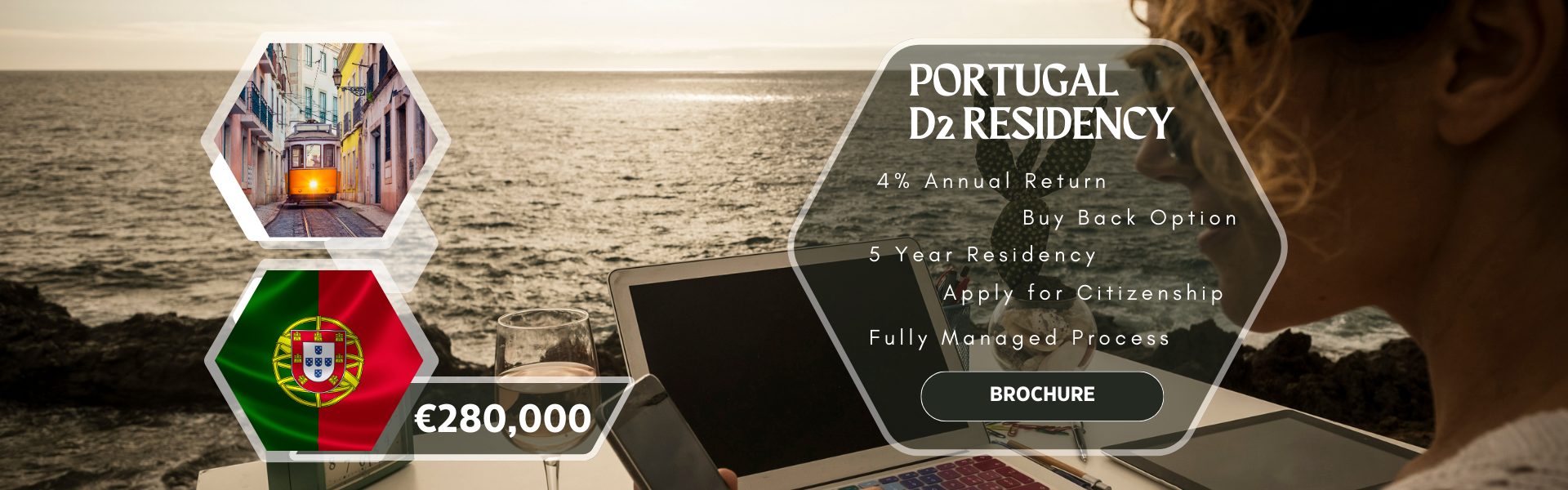

How much do Residency & Citizenship Investments cost in Portugal?

- The D2 Residency Visa is now the cheapest and fastest way to secure Residency in Portugal, which leads to Citizenship. This package is €280,000, giving a 4% annual return and buyback in year 6.

- With Investment funds in Portugal that qualify for the Golden Visa, you can invest €250,000 in two funds, which equals the €500,000 needed to be eligible for the traditional Golden Visa Portugal.

Qualifying Portuguese Golden Visa Investment Funds

The first is called the Football Strategies Fund. This fund aims to acquire three different football clubs and develop them from a junior league to the premier league in the country. The goal is to generate exceptional profits. A football club is an exciting machine of affiliation, managing and developing players’ careers and talents.

We’ve hired the team chosen by RedBull to help us achieve this strategy and build and develop our portfolio of football clubs in Latin America and Europe.

The second fund is the Finance Fund, which is changing the landscape in Portugal. It aims to help Portuguese companies finance their renewable energy portfolio through solar- and wind-energy-efficient producing facilities. We’ve been investing in these projects for the last three years, and they’ve proved to be stable and very generous.

The fund aims to distribute a yearly dividend of 8% pa and capitalize the remaining income. We’re registering the fund under the most advanced ESG policy to achieve green investment status.

The third fund is the Agrobusiness Fund. It aims to invest the first 60% of AUM in Portuguese agricultural projects relating to water efficiency in farming and cattle management. The area has been indicated as a significant new sector where a new industrial development shock is needed.

With the remaining 35% of AUM, we seek to invest in new forest areas, mainly in the Portuguese-speaking African countries, particularly Angola and Mozambique.

With the exposure to these countries, we align the investment with the exceptional objectives of impact investment, working along with local communities, allowing for a broader diversification of land uses, and permitting cattle management at a smaller local scale.

The last fund launched was the Entertainment Fund. The entertainment business in Portugal has been growing over the previous 15 years, and we want to be part of this growth potential. We will capitalise on the experience we have gathered with the Growth Fund investing in Restaurants, Bars, Rooftops, and concessions and take another step with a team specialised in the Entertainment business in Portugal.

This Fund will focus on licensing spaces for entertainment such as festivals, concerts, and theme parks, investing in the setup of shows, restaurants, and bars, and finally taking part in developing tech companies related to the entertainment business.

Luxury Development in Athens for 250k Golden Visa

- From €250.000

- Bed: 1

- Bath: 1

What Is a Portugal Golden Visa Investment Fund?

The introduction of the investment fund route for the Portugal Golden Visa occurred as an amendment within Portuguese Law no. 102/2017, dated August 28th, 2017. This amendment stipulates that a capital transfer of €350,000 revised to €500,000 in 2023 or more can secure units of investment funds or venture capital Portugal fund of funds. Under Portuguese law, these funds are dedicated to company capitalization, requiring a minimum maturity of five years upon investment. At least 60% of these investments must be realized within national territory-based commercial companies.

Part of the broader Portugal Golden Visa Program, the Investment Fund route presents a pathway for investors seeking residency. They contribute to the nation’s economic growth by engaging with qualifying funds. Participation in these funds offers eligibility for a golden visa, providing the investor and their family access to living, working, and studying in Portugal. The scope of eligible investment funds encompasses diverse industries such as real estate, tourism, technology, and renewable energy. Rigorously chosen and overseen by the Portuguese government, these funds are aligned with the country’s economic development goals.

Who Can Invest in Golden Visa Portugal Investment Funds?

The Portugal investment fund for Golden Visa is accessible to a diverse array of investors, encompassing individuals, families, and business entities. Non-EU/EEA citizens qualifying under the criteria can pursue the golden visa by fulfilling the minimum investment prerequisite. Before embarking on the investment journey, comprehending the distinct requisites and confines is paramount.

The prerequisites for obtaining a Golden Visa include the following: candidates must be 18 years old and possess an unblemished criminal record. Furthermore, the origin of the investment capital must be lawfully acquired. The investment avenue is accessible through individual engagement or a corporate entity under the stipulation that the applicant holds a substantial ownership stake in the enterprise.

The procedure for applying to the Portugal Golden Visa program through investment funds involves meeting the primary requirements for a Golden Visa.

These criteria encompass:

- Non-EU/EEA and non-Swiss citizenship,

- A clean criminal record.

Additional prerequisites may be imposed by the chosen Portugal investment fund and its management firm.

These supplementary conditions generally include the following:

- Demonstrating financial acumen, indicating familiarity with financial instruments like company stocks, government bonds, company bonds, funds, etc.,

- Providing evidence of ample funds,

- Validating the source of the funds.

American citizens can invest in Portuguese investment funds to secure a Golden Visa. However, it’s important to note that U.S. tax regulations mandate foreign financial institutions and specific non-financial foreign entities to disclose information regarding the foreign assets held by U.S. account holders.

Consequently, Portuguese banks, funds, and fund managers dealing with American clients must comply with rigorous U.S. government regulations. While some financial institutions and Portuguese investment funds may hesitate to engage with U.S. citizens due to these compliance burdens, some banks and funds welcome American investors. Please contact us for further information regarding qualifying funds and the Portugal Golden Visa investment guide for 2024.

Advantages of Portuguese Golden Visa Investment Fund

1. Diversification: Portuguese legislation mandates a specified level of diversification within funds. Prescribed quotas dictate the permissible percentage of a singular asset or investment within the fund’s portfolio. This regulatory measure facilitates investment diversity within the fund, effectively diminishing risk exposure for participating investors.

2. Tax Efficiency Benefits: The tax efficiency of fund investment is contingent upon the fund’s tax structure and the investor’s status. Remarkably, certain scenarios grant exemptions from withholding tax on fund-generated income, especially pertinent when investors are non-residents for tax purposes in Portugal. Conversely, real estate rental income is subject to a fixed 28% taxation within the country.

3. Robust Regulatory Oversight: Investment in a registered Portugal fund entails oversight by multiple regulatory bodies, namely

(1) The Portuguese Securities Market Commission (CMVM)

(2) The Bank of Portugal, and

(3) The external Fund Management company. Furthermore,

(4) Scrutiny by the Portuguese Tax Authorities ensures compliance with national legislation, tax regulations, and the approved investment strategy, reassuring investors of the fund’s secure adherence to regulatory guidelines.

4. Minimal Fees and Taxation: Opting for fund investment mitigates substantial fees and taxes imposition, as observed with real estate acquisitions. Property acquisition in Portugal involves an IMI transfer tax (averaging 6%), stamp duty (0.8%), and annual municipal taxes (ranging between 0.3-0.5% annually). Conversely, investment in a fund remains unburdened by these fiscal obligations.

5. Favorable Investment Threshold: In contrast to alternative avenues within the Portuguese Golden Visa program, such as the capital transfer option requiring €1.5 million, the investment fund pathway necessitates a comparatively modest investment of €500,000 that can be spread over several funds investing in a variety sectors.

6. Prospective Returns: The fund’s targeted focus can yield annual returns and eventual capital appreciation markedly exceeding alternative Golden Visa-related investment options.

7. Simplified Management: Ownership of a participation unit in an investment fund represents an uncomplicated investment choice compared to the obligations of a real estate landlord. Fund management responsibilities are delegated to competent fund managers, streamlining investor involvement. It is noteworthy, however, that this aspect might be less appealing to individuals inclined toward direct control, a point expounded upon in the forthcoming “Disadvantages” section.

Disadvantages of Portugal Golden Visa Fund

Exit Strategy and Considerations

Profit Sharing Dynamics

Know-Your-Client (KYC) Responsibility

Portugal Golden Visa: Fees and Costs

- Minimum Investment

As of late 2023, these minimum investment thresholds stand as follows:

– Real Estate Property: REMOVED

– Capital Transfer: Investors can opt for a capital transfer investment, which involves transferring a substantial sum of €1.5 million to Portugal. This investment can take various forms, such as bank deposits, share capital of Portuguese companies, or even investment in government bonds.

– Investment Fund: The investment fund route enables investors to contribute a minimum of €500,000 to qualifying investment funds. These funds are typically designed to support the country’s economic growth by investing in various sectors such as real estate, technology, tourism, and more.

However, it is essential to note that significant changes have been introduced through the “Mais Habitaçao” legislation, effective from late 2023. Under this legislation, the eligibility criteria for the Golden Visa program have been revised. Notably, investors can no longer utilize real estate investments, real estate-related funds, or capital transfers to apply for a Golden Visa in Portugal.

- Taxes

When considering the financial implications of the different investment options within the Golden Visa program in Portugal, it’s essential to consider the various tax components involved. These tax elements can significantly influence the overall cost of the investment and subsequent residency application. As of the current regulations, the taxation framework for each investment avenue is as follows:

- IMI Transfer Tax: This tax pertains to acquiring real estate properties and is calculated as a percentage of the property value. Depending on the investment option chosen, the applicable rates are as follows:

– Real Estate Property: The IMI Transfer Tax for real estate properties falls within the range of 4.58% to 6.5%, varying based on the specific property value and location.

– Capital Transfer: Interestingly, capital transfers as an investment avenue are exempt from the IMI Transfer Tax. This means that investors opting for this route can avoid this tax burden.

– Investment Fund: The IMI Transfer Tax does not apply to the Investment Fund option. This exemption can contribute to more favourable financial terms for investors utilizing this pathway.

- Stamp Duty: Stamp Duty is another tax element that adds to the total cost of certain investment types. The rates for Stamp Duty across the different investment avenues are:

– Real Estate Property: A fixed rate of 0.8% of the property’s value is applicable as Stamp Duty for real estate acquisitions.

– Capital Transfer: Similar to the IMI Transfer Tax, the Capital Transfer option also enjoys exemption from Stamp Duty.

– Investment Fund: The Investment Funds option, once again, does not incur Stamp Duty, aligning with the pattern of tax benefits associated with this choice.

- Notary Cost: Additional administrative costs exist beyond taxes, such as notary fees. These fees are incurred during the legal process of property or investment transactions. For the various investment avenues:

– Real Estate Property: Notary costs typically amount to around €1,000 when investing in real estate properties.

– Capital Transfer: This option does not involve notary costs.

– Investment Fund: The Investment Funds avenue is exempt from notary costs, contributing to a potentially more cost-effective investment process.

Considering these nuanced tax and cost factors associated with each investment route can provide a comprehensive understanding of the financial implications of the Golden Visa program options in Portugal. This insight allows investors to make informed decisions that align with their budget and financial goals.

- Exit Fees

- Real Estate Property: If you choose the real estate property option for your investment, an exit fee of 5% of the property’s value plus Value Added Tax (VAT) applies. This fee is designed to cover the costs associated with exiting a real estate investment.

- Capital Transfer: This investment avenue does not entail any exit fees. You won’t be subjected to additional financial deductions when opting for this route.

- Investment Fund: Similar to the Capital Transfer option, the Investment Fund route does not involve exit fees. This fee exemption can contribute to a more straightforward and cost-effective exit process for investors.

- Management Fees

When considering the financial aspects of your investment options within the Golden Visa program, it’s essential to account for management fees, which can influence your investment’s overall profitability. Under the existing regulations, the management fee structure for each investment avenue is detailed as follows:

– Real Estate Property: No management fees are imposed for investments made in real estate properties, providing a straightforward financial approach.

– Capital Transfer: If you choose the Capital Transfer route, a management fee of 0.5% is applicable. This fee accounts for the administration and oversight of the investment.

– Investment Fund: Opting for the Investment Fund route entails an annual management fee of 1.5% of the invested amount. However, it’s essential to recognize that the specifics of the management fee can vary depending on the chosen investment fund. Generally, annual management fees for investment funds typically fall within 1% to 2% of the invested capital. This fee encompasses the professional management of the fund, strategic decision-making, and ongoing supervision.

- Legal Fees

Exiting the Portugal Investment Fund for Golden Visa

Navigating the Exit Process

As discussed in the delineation of advantages and disadvantages of the Portugal Golden Visa investment funds, the exit strategy merits comprehensive exploration.

- Minimum Lock-up Period

Most qualifying investment funds for the Golden Visa impose a minimum lock-up period of at least six years. This deliberate temporal structure ensures the investment’s viability for the requisite duration to pursue Portuguese citizenship. While this safeguards the alignment between investment and residency goals, additional considerations warrant scrutiny.

- Resale or Transfer of Participation Units

Portuguese investment funds commonly permit the transference or sale of participation units between investors. However, the demand for such units specifically timed for Golden Visa application timelines is typically scarce, except during the fund’s inception. Consequently, these fund investments may demonstrate limited liquidity until the fund manager initiates dissolution. Some funds address this liquidity challenge by proposing participation unit buy-backs at a predetermined discount.

- Extension Periods

Predominantly, investment funds include an exit target timeframe, often six years, to harmonize with Golden Visa aspirations. Despite this, numerous funds incorporate optional extension periods initiated after the initial six-year span. Notably, the discretion to trigger extensions resides with fund managers, underscoring the importance of investor inquiry. This dynamic suggests that investors could remain committed beyond the period requisite for Portuguese citizenship attainment.

- Exit Strategy and Performance

A core aspiration for most Portugal Golden Visa funds entails a profitable exit strategy achieved through portfolio divestment. Fund managers are typically incentivized through performance fees linked to appreciation percentage. This alignment of incentives with investor interests is favourable, although it is essential to acknowledge the division of profits while retaining potential loss exposure.

Comprehending the multifaceted aspects of exiting the Portugal Golden Visa Investment Fund is pivotal. This holistic understanding empowers investors to make informed decisions, aligning their exit strategy with broader financial objectives and residency pursuits.

Portugal Golden Visa Investment Fund: Essential Documents and Requirements

- Personal Identification: A valid passport or government-issued identification is a fundamental requirement.

- Healthcare Coverage: Substantiate your healthcare coverage either through documentation of enrollment in the Portuguese National Health Service or an internationally recognized health insurance plan.

- Criminal Record: Furnish a criminal record issued within three months of application submission from your country of origin or residence. Ensure its translation into Portuguese.

- Tax Identification Number (NIF): Provide your tax identification number from your country of origin or tax residence.

- Application Form: Complete the application form granting authorization to consult your criminal record within Portugal.

- Compliance Statement: Submit a letter affirming your adherence to the minimum time requirements associated with the respective investment activity in Portugal.

- Payment Receipt: Include the payment receipt as evidence of the application fee for the Autorização de Residência para Atividade de Investimento (ARI) – the Golden Visa.

Investment Related Documents

Demonstrate the fulfilment of the minimum investment through a set of corroborative documents:

- A declaration from a registered Portuguese institution confirming the successful transfer of the requisite investment amount.

- A supporting document delineating your ownership of participation units, unencumbered by any obligations or charges.

- A declaration issued by the managing company of the investment fund outlining the business plan, maturity dates of at least five years, and a commitment to deploy a minimum of 60% of the fund portfolio towards investments in Portugal.

Portugal

- Investment Options: Fund investments

- Minimum Investment: €500,000

- Residency Requirement: Minimum of 7 days in the first year and 14 days in subsequent two-year periods.

- Path to Citizenship: After 5 years of holding the Golden Visa

Greece

- Investment Options: Real estate and strategic investments.

- Minimum Investment: €250,000 in real estate.

- Residency Requirement: No minimum stay requirement.

- Path to Citizenship: After seven years of legal residency.

Spain

- Investment Options: Real estate, business projects, bank deposits, and public debt.

- Minimum Investment: Typically starts from €500,000 for real estate.

- Residency Requirement: No minimum stay, but must visit Spain

- Path to Citizenship: 10 Years

Timeline

- Selecting the Right Investment Fund: Choose an investment fund option that aligns with your objectives and preferences.

- Professional Assistance: Engage a reputable law firm to guide you through the intricacies of the process.

- Legal Formalities: Acquire a Portuguese tax identification number (NIF) and establish a bank account within Portugal.

- Completion of Documentation: Thoroughly complete and sign all essential fund subscription documents.

- Investor Approval: The fund manager assesses your eligibility and grants approval as an investor.

- Fund Transfer: Initiate the transfer of the requisite funds from your bank account to the designated fund account.

- Declaration of Fund Subscription: The fund manager issues an official declaration confirming your subscription to the fund.

- Documentation Submission: Deliver all Golden Visa documentation to your law firm and fulfil the requirements of the SEF application fee.

- Biometrics Appointment: Schedule and attend an in-person biometrics appointment at the SEF office.

- Residence Permit Issuance: SEF issues an initial two-year residence permit upon completion.

- Continuous Progress: Continue the renewal of your Golden Visa residence permit biennially, embarking on the journey toward eventual Portuguese citizenship.

Frequently Asked Questions on Golden Visa Investment Fund Portugal

What minimum investment is required for the Portugal Golden Visa Investment Fund?

The minimum investment amount for the Portugal Golden Visa Investment Funds is €500,000 cash investment but this can be invested in two different funds for diversification.

Can I include my family in the Golden Visa application?

Can I work in Portugal with the Golden Visa?

How long does it take to obtain the Golden Visa?

The processing time for the Golden Visa application can vary, but it typically takes a few months from applying for issuing the residence permit.

Can I invest in multiple funds to meet the investment requirements?

Can I apply for Portuguese citizenship after obtaining the Golden Visa?

What are the tax implications of the Golden Visa investment?

Are you seeking residency in Portugal and eventual EU citizenship? Look no further than the Portugal Golden Visa Investment Fund. Our guide provides comprehensive information on the program, including advantages, disadvantages, fees, and the application process.

Investors can confidently navigate this pathway with professional guidance and make informed decisions. Portugal is an open and thriving European country, and a carefully considered investment strategy with the Portugal Golden Visa Investment Fund can lead to a bright and prosperous future.

Evaluating multiple factors is imperative when assessing whether the fund option aligns with your investment objectives. Each fund is designed to showcase its offerings, so partnering with us is strongly recommended. We will steadfastly advocate for your interests throughout the decision-making process.

Stay Updated with BondTilli

The World of Investment Visas is Ever-Evolving.

Stay ahead of the curve with the latest updates, insights, and opportunities in the realm of investment visas. From regulatory changes to new program launches, BondTilli ensures you’re always in the know.

Newsletter Signup

Why Subscribe?

Latest Updates:

Be the first to know about new visa programs, property listings, and investment opportunities.

Exclusive Insights:

Gain access to in-depth articles, market analyses, and expert opinions.

Special Offers:

Enjoy exclusive offers, discounts, and early access to our premium services and properties.

Community Engagement:

Join webinars, virtual events, and discussions hosted by Bond Tilli and industry experts.